Beyond the Spreadsheet

to deliver the Deal Value

The Deal Value is Defined in Spreadsheets

The Deal Team is a group of people that find, negotiate, and put together an acquisition with a vision of value that will be created after the businesses are combined. This value is defined in spreadsheets and other documents.

Delivering the Value is a Group Effort

Integrations move beyond the spreadsheet to deliver value

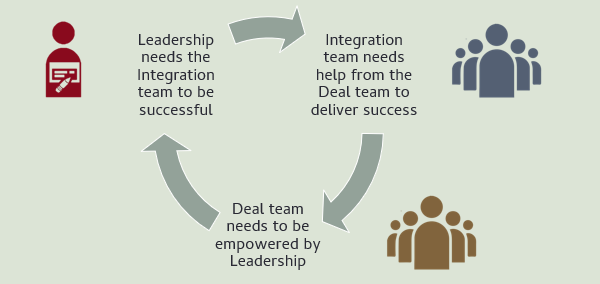

Purchasing a business does not deliver the value: it comes from the integration of the two businesses. The purpose of the Integration Team is to deliver the value defined by the Deal Team:

- Turn the vision into a plan

- Execute the plan to deliver the value

- Track and report the progress

The Deal Team has detailed knowledge of what value can be achieved, which suggests they should transfer their knowledge of the business and the insights they have recently gained, to the Integration Team.

Why should the Deal Team be concerned about the post-close activities?

Accuracy in the Valuation

It takes time to deliver the value drivers, for example to modifying a logistics network, or to embed an acquired technology. This time and cost requires identifying the activities, pricing them, and adding the costs into the financial forecast, to accurately value the deal.

The better a Deal Team is at forecasting, the more accurate the valuation.

Become a Better Deal Maker

Understanding the practicalities of delivering the value of a deal makes you a better Deal Team member

- If you understand what is involved, it makes you more skilled at your work

- It gives you credibility

- It empowers you during negotiations with others who already understand this

Prevent Negative Association

Employees talk about "acquisitions", but are usually talking about the experience of integrating the two businesses together

- If an "acquisition" gets negative talk, the Deal Team are associated with that negativity

- Prevent negative outcomes by setting up the integration for success

Owners: Maximize your Investment

If you're an investor, you will want the biggest ROI possible. Getting involved in the integration will help maximize the value of your business.

Lenders and Advisors: Get Repeat Business

If you're a lender or advisor, you have devoted time to nurture a relationship that matured into an acquisition. Why end the relationship when a deal is closed?

- Show your client an interest in their success, by handing off to the integration team

- Helping the integration is helping yourself: if the integration goes well, there is a better chance of another opportunity for you

- Defaults are not that common with acquisitions, but why risk it? Empower the integration team to make the merger successful

Our Insight Document on how to budget your next M&A integration

The Most Influential People in an Acquisition Integration

There are two groups of people that can most affect the success or failure of an integration

- The leadership of the acquiring business

- Middle management of the acquired business

Read more about it here:

How the Deal Team can contribute to a successful integration

- Without getting distracted from their core purpose

1.

Bring the integration team as early as possible

There is clear evidence that the earlier the integration team is introduced, the higher the odds of integration success

3.

Give insights to avoid future problems

The Deal Team will have spent a lot of time with leadership of acquirers and sellers. They get insights into the businesses and their leaders. These insights can be extremely helpful in making the integration a success.

The Integration Team will not have the lengthy exposure to the entire leadership, and will not have these insights. The Deal Team can pass important insights that can avoid costly delays or mistakes, for example:

- One partner is heavily distracted by a messy divorce, and should not be involved in the integration

- The seller wants to drop their payroll system ASAP due to a deteriorated vendor business relationship

- The seller has severely underinvested in the manufacturing facility

- The acquirer is about to replace their CRM, which will affect technology decisions and the availability of many people

- Due Diligence discovered an unfavorable clause in the resellers' contracts

2.

Have a clear set of objectives for the integration to deliver

The Deal Team has reason(s) for acquiring the business, and a vision of how the two businesses should work together. Clarify exactly what you want the Integration Team to deliver, for example:

- Revenue targets

- Financial synergies

- KPIs

- Operational changes e.g. create a single warehouse and distribution network

- Staff retention levels

- What features are in a released product

This can be communicated to the integration team in as little as a 1 hour meeting

4.

Include people from the Deal Team in the Integration Team

- Even a limited engagement will enable knowledge transfer

5.

Don't underfund the integration

- Costs vary from 8 to 30% of the deal price, with the average being 14%

- Biggest spend is on IT

- Budget more than you expect for the integration, but don’t give the money away. Keep it for contingencies