What is Acquisition Integration?

(AKA Post-Merger Integration)

After you Buy a Business, You have Two Businesses

Businesses are acquired for the potential growth they can bring, for example, the ability to offer new products, or to sell existing products in new markets. To be able to grow, all or parts of the businesses must work as seamlessly as possible together in an efficient manner, which requires all or some of the parts of the businesses to be integrated together.

Integration is the thoughtful alignment of disparate people, processes, operations, technologies and cultures in the pursuit of added value.

After an acquisition, we own what was someone else's business. The handshake at the close of the deal does not automatically transform our purchase. What we envision for our new business now has to become whole.

When we integrate (or "merge") all or parts of the businesses together, the process is known as "Post-Merger Integration" (PMI).

Creating a larger harmonious business

To create this opportunity for growth you will need a larger well-functioning business. Forcing the consolidation of teams and operations, without consideration of the effect upon the business culture, will have a long-term effect upon its trajectory.

A well-functioning platform business is necessary to create the opportunity for growth. The consolidation of teams and operations will have a long-term effect upon the trajectory of the combined business. Careful consideration of the effect upon the collective business culture is of the utmost importance.

The integration of smaller businesses requires a focus upon the people who make up that business, as they are a significant portion of its latent value.

With smaller businesses, how you integrate is as important as what you integrate

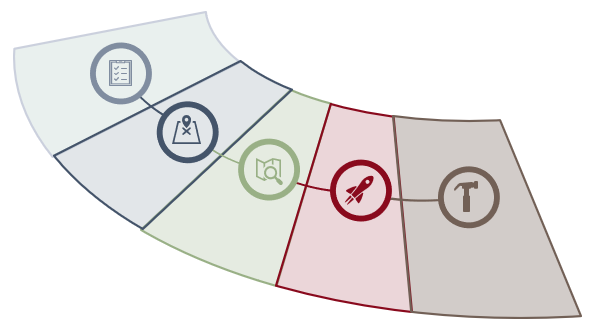

The integration includes assessing, planning, budgeting, supporting and training, to deliver the value that the Deal Team envisioned

People

Technologies and Products

Operations

Processes

Business Cultures

The Complexity of Post-Merger Integration

When you integrate businesses, you combine and transform the businesses by:

- Addressing these 5 aspects of integrations

- Accommodating different business structures and functions

- Sustaining the revenues

- Allaying the concerns of employee who are unaccustomed to lots of change

Every business has its own unique blend of the five aspect. Within the business, each team, department, or office can have their own variations of these aspects.

How Complete is Your Integration?

Take this survey to get an approximation of how complete your acquisition integration could be.

This short survey provides an estimated completion percentage score, based upon a few questions.

A 30% Success Rate

The success of mergers and acquisitions has been measured* since the 1970s. Unfortunately, the data is not related to the transactions; it is the integration of acquired businesses that often fails. Delivering what was envisioned when the deal was put together is difficult. Once the transaction has taken place, without foreseeing possible problems but money has exchanged hands, an unplanned integration is likely to fail.

What is the value of an acquisition, without integration?

The delivery of a well-planned acquisition integration increases the value of your business, enabling it to grow more quickly, giving a greater return on investment (ROI).

Businesses that do not successfully integrate acquisitions waste the opportunity of value creation. With every subsequent acquisition, the pain of not integrating becomes greater, as the burden of multiple processes, tools and operational methods prevents growth.

Intista's integration success rate is 90%

*Joshi, M., Sanchez, C., & Mudde, P. (2020). Improving the M&A success rate: Identity may be the key. Journal of Business Strategy, 41(1), 50–57. https://doi.org/10.1108/JBS-08-2017-0115

Dr Kelvin Mukolo Kayombo, (2019), Critical Assessment of Performance of Mergers and Acquisitions , The International Journal of Business Management and Technology, Volume 3 Issue 1 January - February 2019

The Challenge Ahead

The challenge of acquisition integration is to merge two businesses and all the teams within them, with all their unique characteristics - while simultaneously maintaining the revenues, retaining the staff, sustaining productivity, running processes, and servicing customers.

Find out how we train your employees to be your in-house integration teams

5 Reasons why businesses want Certified Integration Managers

1. A successful integration team delivers the value defined by the Deal Team

- Incomplete integrations are missed opportunities to realize the value envisioned by the deal-makers

- Integration of the two businesses, not the purchase, is what delivers value

2. Expertise which is in-house, is transferred between successive acquisition integrations

- An in-house acquisition integration team has the benefit of existing business relationships, but may not have the knowledge to deliver integrations

- Invest in your team, and transfer experiences between successive acquisition integrations

3. Control the cost of bringing in external integration expertise

- Training and certification is often a more predictable expense than deploying expertise to deliver integrations for you

4. Improve the way that you approach and deliver integrations in the future. If you already acquire and integrate, avoid the cost of inefficient methods in:

- Staff retention

- Faster onboarding

- Improved productivity

- Staff engagement

5. Trained employees are happier employees

- Certified employees perform faster, are more engaged, and have better work outcomes*

- Organizations that invest in employee training demonstrate that they have faith in that employee and morale improves

- Improved morale creates more engaged employees, which makes them more productive

Conquer operational performance challenges in acquired businesses

Intista’s Certified Acquisition Integration Manager™ program applies our proprietary Small business Simplified Integration Method (SSIM™) which establishes a repeatable process to improve integration efficiencies.

Develop your company’s in-house acquisition integration expertise and capabilities through our Certified Acquisition Integration Manager™ (CAIM™) program.

Our CAIM™ program covers how to plan, announce, and run the integration of an acquired lower-mid or mid-size.

Learn More from Our Blogs

Middle Managers: Five Ways to use this Success Connection

In smaller businesses, middle management (along with the Office Manager) are close

Office Politics during Integrations – Decision Making

After an acquisition, the decisions made during the integration can have significant

When Should you Begin Integration?

If your business growth strategy is acquisition, and you want to get